All Categories

Featured

A financial investment vehicle, such as a fund, would have to identify that you certify as a recognized financier (accredited investor vs qualified purchaser). The benefits of being a certified financier consist of accessibility to unique investment chances not offered to non-accredited investors, high returns, and raised diversity in your profile.

In certain areas, non-accredited financiers additionally have the right to rescission (accredited finance). What this indicates is that if an investor decides they want to take out their cash early, they can assert they were a non-accredited investor during and obtain their cash back. Nevertheless, it's never ever a good idea to provide falsified documents, such as phony income tax return or financial declarations to a financial investment vehicle just to invest, and this might bring lawful problem for you down the line - real estate crowdfunding for non accredited investors.

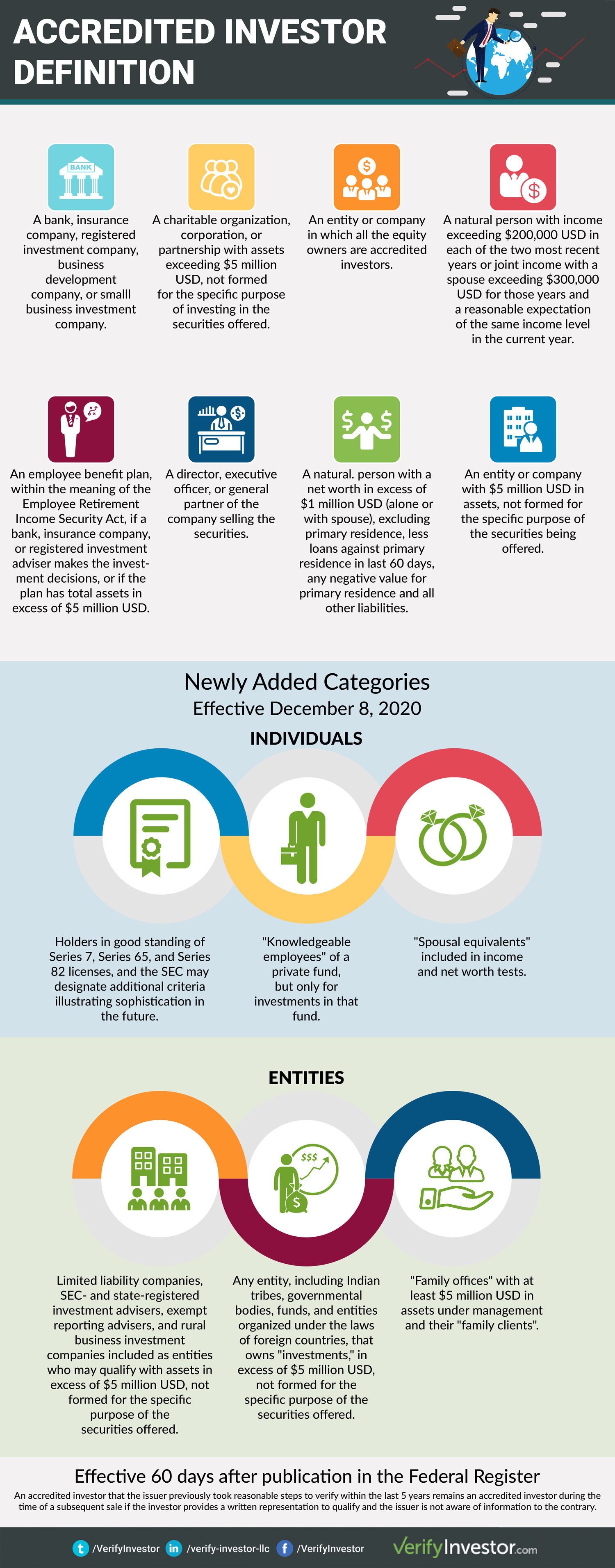

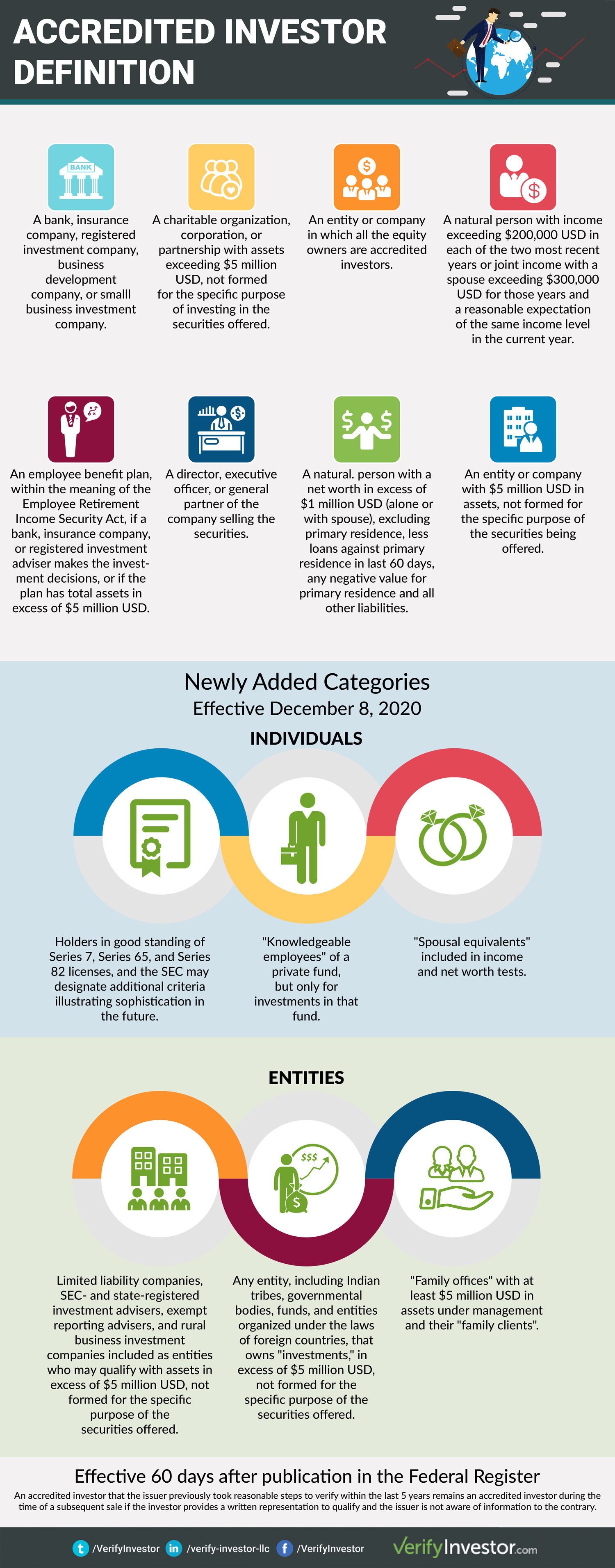

That being stated, each bargain or each fund might have its very own limitations and caps on investment quantities that they will approve from a capitalist. Certified investors are those that meet particular needs pertaining to earnings, qualifications, or net worth.

Latest Posts

Property Taxes On Foreclosure

Tax Lien Deed Investing

Tax Default Homes